Special Message April 2023

The Investment Environment and Big Risks That Today’s Investors Face

By John Goltermann, CFA, CGMA

Below are some factors that have the potential to negatively impact individuals’, especially retirees’, personal finances and some general opinions on how to position based on today’s long-term risks/opportunities:

Deflationary Forces:

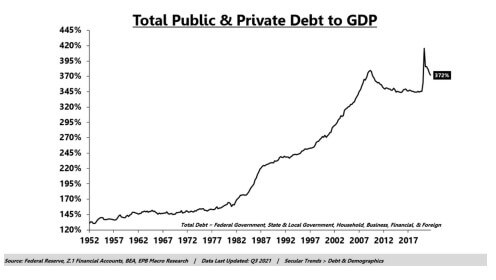

- Excessive debt levels make financial system more fragile.

- Government budgets will be squeezed going forward by much higher interest expense meaning a lowered ability for government services and handouts. Each 1% increase in rates is $330 billion of new interest expense on the Federal debt alone. State and municipal budgets are also affected. That has the potential to crowd out spending, and increase the supply of bond issuance putting upward pressure on rates.

- Highly interventionist Federal Reserve encourages more debt (subsidizes it through repressed rates), ad hoc rule changes and bailouts impair systemic confidence and free market flows (in the end putting deflationary pressure on the system).

- Highly concentrated benchmarks (S&P 500), i.e., tech sector 35% weight, top stocks (MSFT and AAPL) are 14% of index, top 5 stocks 20% — this will meanrevert at some point.

- Fragile banking system: massive unrealized losses on bank balance sheets from interest rate increases –> deposit runs –> rule changes creating 2-tier banking system –> flight to “protected” SIFI banks –> concentration in banking/government financing –> more bank failures credit contraction –> job losses recession.

- Disintermediation (bank deposit flight to money market funds impairs banking/credit expansion).

- Expensive US stock market.

- High rates increase recession risk and induce asset price declines including people’s primary residence and closely held businesses.

- Layoffs in tech, private equity happening.

- Delinquencies increasing across loan types.

- People less wealthy overall from stock and bond declines in 2022 creates an environment of lower risk-taking, lower investment, less entrepreneurship, etc.

- Bond value declines from widening spreads and rising rates (from inflation) risks debt crisis.

Inflationary Forces:

- Generally poor health of labor pool (low productivity, absenteeism, low numbers).

- Demography – aging population, declining labor force participation.

- Supply chain impairment is long-lasting.

- Highly interventionist Federal Reserve and Congress, i.e., money printing, interest rate suppression, bailouts, handouts, stimulus programs, etc., floods the system with dollars (in the end puts near-term inflationary pressure on the system).

- Worsening Geopolitics/Trade backdrop/De-globalization.

- Money printing increases inflation.

- Government has incentive to create inflation to socialize costs of failures, programs, stimulus, excesses.

Other forces:

- Algorithms (non-humans) drive daily trade.

- Pervasive liquidity preference for US stocks (for now) even though that is generally not where value is.

- Declining quality of education broadly.

Thoughts on the Above:

The above long-term factors are what we have to deal with as investors. There are both inflationary and deflationary forces afoot. The government has the power (and the incentive) to enact policies that are inflationary, as evidenced by Covid-related economic shutdown (printing money concurrently) and handing out direct payments. Inflation is one way to discharge the massive amount of debt in our system by enabling creditors to pay back their debt with cheaper (depreciated) dollars, so perversely, we may see continued inflationary policies, i.e., stimulus after stimulus, more regulation, money printing, QE, handouts, shutdowns, etc. The benefit to the government is it masks the cost of policies by spreading it out to everyone (instead of through taxation), but of course it hits people at lo -income levels and retirees the hardest. The other ways to discharge debt is through outright defaults…not defaults on tradable debt (Treasurys), but default on promises. The third way is through pro-growth, pro-business policies, which, in my opinion, this administration is not (see next chart) inclined to do.

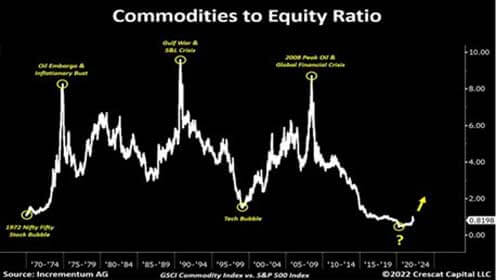

So, stagflation is a real risk going forward. Is it a 100% risk? No. But it’s much higher than normal. Stagflationary environments are hard for many investments and the inflation component destroys the real value of safe investments. Stagflation would generally be a dollar-negative environment, meaning investments that benefit from a weak dollar would outperform. Stagflation would be very bad for tech stocks (and the S&P 500), small cap and companies that sell in dollars and have costs derived in foreign currencies. It would be generally good for resource producers, foreign stocks, US companies with lots of revenue from abroad, gold, etc. This is not a prediction, but at this point in time dollar negative investments are cheap and strong dollar investments, i.e., tech stocks, are not. The chart below is one that argues for positions in resource producers and commodities in a long-term portfolio today. They are cheap on a relative basis:

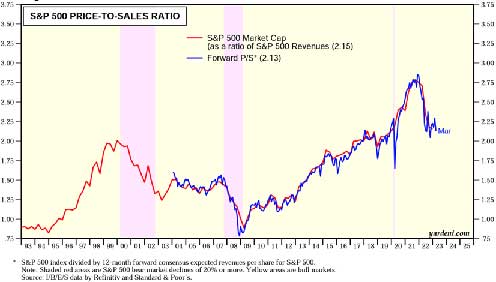

Another chart (below) shows the relationship between stock prices (total market cap of S&P 500 companies) per dollar of sales (the price-to-sales ratio) through time. Low ratio is a cheap stock market, high is an expensive market. Stock prices became extremely expensive November of 2021 from Covid policies, and they gave back a lot of the excess in 2022. But you’ll see that that price-to-sales ratio today is higher than it was at the top of the tech bubble. And when there was a recession after the top of the tech bubble that ratio went from 2 to 1.25 (on declining sales in tech, which saw the tech-heavy NASDAQ decline 72% from the top in March 2000, to Dec. 2002). And from the top of the tech bubble the S&P 500 had a 0% nominal return, and a negative 1.4% real (after-inflation) return for 10 years. Again, not a prediction, but a real risk. Markets do mean-revert from extreme levels. And you’ll see that on average the ratio tends to be around 1.00 – 1.50 in markets not pumped up by the Fed.

So, what is the best way to position the capital accumulated by retirees (their stored labor) today to protect them from the myriad risks and distortions in markets they face? It’s not easy. But, in my opinion, a start would be by not building a portfolio that looks like the heavily tech-dominated S&P 500. Prices are distorted from 15 years of heavy Fed intervention driving everyone into indexes (people had to take some kind of risk because there was no alternative in a zero-rate environment so many defaulted to the S&P 500 index).

There will be times that the S&P 500 does well on a relative basis simply because of the liquidity preference and the fact that algorithms drive trade and rotate into indexes by default. This is one of those times. These are not the results of thinking, rational, long-termoriented human beings looking for well-priced opportunities. Nor are they driven by fundamentals/valuations or the risks. And if clients hold us to account for relative performance to the S&P, it impairs our ability to do our job, which is to think long term and position in order to help maintain clients’ standard of living. In a very risky macro environment. With gale-force headwinds mentioned above.

The truth is that our clients shouldn’t want us to try to beat the S&P 500. Because that would require us to construct our portfolio to look largely like the S&P 500 and load up on tech stocks at exactly the wrong time. And if the S&P trades down 40% and our portfolios are down 37%, that is not a success.

The way I see it is that we have a responsibility to invest for clients in a way that mitigates the above threats to their future standard of living. A huge percentage of retirees’ future cost of living will be driven by energy and health care costs, so we need some direct investment there. Low cost, tax efficient, high quality, etc. And because the overall stock market is trading at high valuations still, an indexer or closet-indexer carries high valuation (downside) risk. Which argues for value investments where there is a margin of safety and that are better supported by valuations. And because stagflation is a significant risk, individual investors need gold.

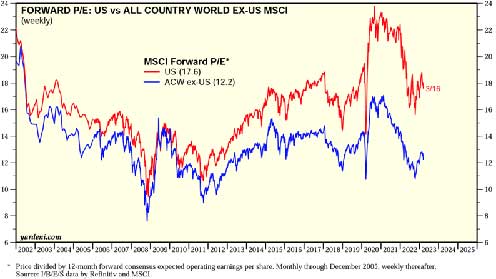

And finally, because of the way the world is going, investors, in my opinion, need some foreign stocks. Not only because they are way cheaper fundamentally (see P/E chart below with foreign and US stocks), but mostly because right now the US is 4% of the global population, 24% of global GDP and 60% of global market cap. If that relative market cap stayed on the trend line from the last 10 years, US market cap would be 80% of global market cap in 10 years. The probability of that happening is extremely low given the excesses in the US, the debt situation, the way that geopolitics is heating up and how cheap foreign stocks are.

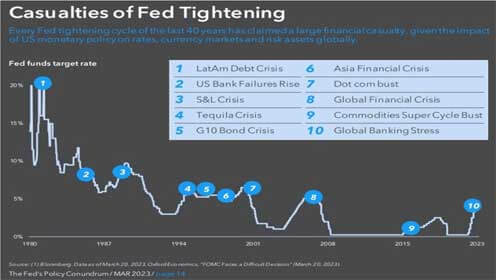

And just for the heck of it, below is one more interesting chart that shows that these crises, such as today’s banking crisis, are normal during tightening cycles: