Investment Management

Investment Framework

What we do is not rocket science. It is work. It isn’t conceptually difficult to understand. It is, however, difficult to do well. There is no formula, algorithm or process that ensures success – just hard work and attention to factors that matter.

Investment results and the risks that your investments carry have a huge impact on your well-being financial, personal, and mental. Accordingly, Townsend takes the business of investing very seriously, with the dual goal of preserving your capital and earning the high returns available in equities. We focus on value, as well as the factors that will likely influence your investments. And because times change, we also want to understand the broad investment backdrop and risk environment.

One of the most important elements of investment success is a workable and sensible investment philosophy that is applied consistently. Many professional investors and traders operate without an investment philosophy and are either 1) short-term oriented and trade often; or 2) they give you an investment portfolio that looks like a benchmark such as the S&P 500 (called closet-benchmarking); or 3) they overdiversify their clients. Accordingly, they trade too often in the hopes of making a quick profit, or they are happy to give you a market return. We believe strongly that you deserve better.

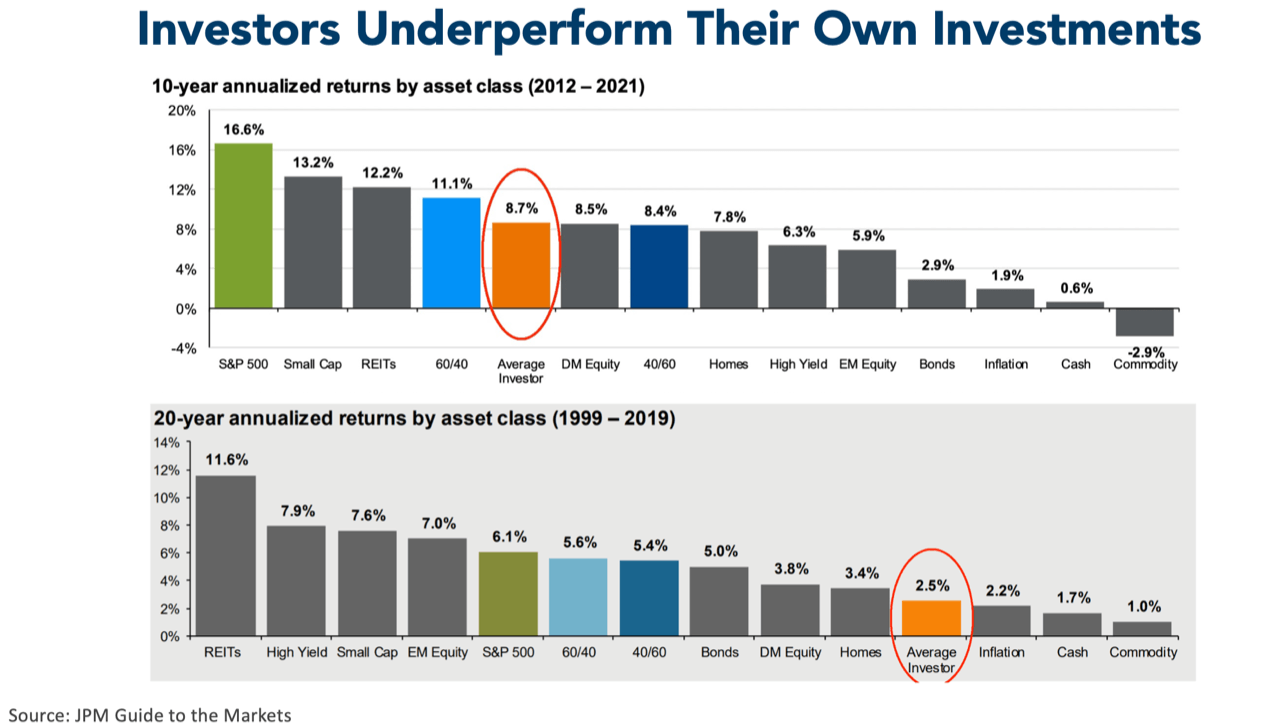

As the chart below shows, neither trading often nor closet-benchmarking gives you high long-term returns or reduces risk. A long-term oriented portfolio of well-researched investments can give you high returns with low risk.

Why do most investors fare so poorly? Because performance chasing, buying ‘popular’ investments and market timing do not work. Imagine driving in traffic. On a highway full of cars some will constantly change lanes to try to get where they are going more quickly. But in traffic, as in investing, changing lanes doesn’t get you there faster. It gives you an illusion of going faster. And in the end all it does is create more risk of an accident. Similarly in investing, many investment advisors will chase popular stocks that have risen in price in an attempt to outperform their peer group. This is what famed investor Seth Klarman calls the “performance derby”. The performance derby induces advisors to take excessive risks and, because past price moves do not predict future price moves, it does not work out well for their clients.

Investment Philosophy

Our investment philosophy page provides a framework for our decision-making. We apply this philosophy to every investment decision we make for you across strategies. At Townsend, our philosophy is multifaceted, and the overarching goal is to get you high value for your investment dollars. As Warren Buffett, would say, “we try to buy dollars for 60 cents.” Essentially it boils down to assuming risks that are likely to be well-compensated and to avoid losses.

Investment Practices, Beliefs, Truisms

Practices

We want to own businesses that can compound shareholder equity either through increases in the value of their assets, or through cash flow that is reinvested in assets that will grow in value.

We want to make investments that have a good chance of being priced a lot higher in the future.

We start with the premise that markets are unpredictable, so we spend no mental energy in trying to predict them. HOWEVER, it is important to understand the overall risk environment and the fact that asset returns will eventually return to historical norms.

We always try to invest with a margin of safety.

We don’t invest in a trading portfolio to try to make fast money.

We will not make market timing or liquidity bets with clients’ capital. We will use valuation and behavioral biases to our advantage.

What we do not own is as important, if not more important, than what we do own.

We target a fixed benchmark of 12% annual return on our equities. It’s a better focus for investment decisions. If we orient to matching or beating a benchmark, such as the S&P 500, it would not help clients. Benchmarks are an arbitrary return, can be hugely risky (when everyone else is indexing like today), and trying to beat it leads to poor quality decisions. Benchmark focus is risk-seeking, and a fixed return focus is risk-avoiding.

We invest where the elements are in place for the stock price to go much higher. Whether it’s improved operating performance, far too cheap on a valuation basis, under pressure due to temporary factors, change of strategy/management team, etc.

There are four types of stocks: 1. Risky stocks that everyone knows are risky (Tesla, unprofitable tech, meme stocks); 2. Risky stocks that people don’t think of as risky (Kraft-Heinz, General Electric, Meta Platforms); 3. Respected companies with beaten down stocks that can appear cheap on the surface, but are actually risky (called value traps), i.e., Intel, Bed Bath and Beyond, IBM; and 4. Beaten down stocks that are actually great companies but trade cheap for temporary/behavioral reasons. The last group (#4) is what we strive to own.

We try to make money and avoid losses by doing the hard work of understanding what we own and putting a conservative value on it. We don’t have any special powers, just experience, an understanding of accounting, finance, economics, markets, and awareness of the behavioral mistakes others make. And having the right tools to do our job.

Beliefs

For the retirement phase of life, you need a portfolio that can withstand a prolonged and possibly severe bear market period as well as an erosion in the value of dollars brought by inflation.

Positioning is the most important thing.

Price declines are not the same thing as ‘losing money’.

Past performance does not predict future performance.

Markets can, at times, be completely irrational. At one point during the pandemic Zoom, a money-losing business, was worth more than Exxon. It is important to be aware of those times prices become unanchored from reality.

Much or the investment industry is set up to create the illusion that something exists that other people can’t have.

The truth about the investment industry is that the people who make investment decisions, and drive stock prices, are doing it with other peoples’ money. Not their own. So, they are in the ‘performance derby’ and focused on short-term outcomes, not long-term risk-adjusted returns. In the process they make huge mistakes. So, we as individual investors, have an obligation to be aware of those mistakes, have the patience to let them play out as mistakes (avoid them), and put money to work productively.

For stocks, a lot of money is made in situations where operating results are less bad than pessimists broadly expect, as opposed to in situations where the operating results of popular investments come in even better than the optimists believe. You also get more margin of safety when you invest that way.

Warren Buffett got rich by not being stupid as opposed to outsmarting everyone else.

The vast majority of advisors do 1 of 3 things: 1. Overdiversify you using a ‘best of breed’ approach; 2. Give you a closet benchmark portfolio, or 3. Give you a momentum-based portfolio of today’s popular investment. None of these serve you.

Markets are partly financial (data driven and quantitative), but also partly behavioral.

Markets inevitably revert to the mean. And you want to be on the right side of mean reversion when it happens.

Markets are composed of capital seekers and capital suppliers. Capital seekers have a financial incentive to mislead you. Capital suppliers have a responsibility not to be misled.

Investing is not about prognosticating the future. It’s about figuring out what are good risks to take and what are bad ones. We know that we don’t know the future and we don’t pretend to.

There’s no rocket science to investing. There’s just time and hard work that it takes to do it well. There is no superior formula, algorithm, or mouse trap.

When you work with a firm that has a large investment committee, the investments that they make reflect a combination of biases, corporate agendas, inter-office politics, and business considerations. In other words, general mediocrity. You are better served with a firm that works hard to mitigate all of that.

Prices reflect a set of expectations. Since markets are completely unpredictable, we try to stack the odds of favorable outcomes in our favor by just owning good long-term investments. And owning good investments means assets that are going to cash flow, and we want to pay less for that cash flow than what it is worth in the present. That sometimes is going to mean owning things that are out of favor or controversial.

In the process of trying to prop up economies by suppressing the price of credit, the Federal Reserve has overridden the price discovery mechanism and distorted asset prices, perverted incentives, and in the process created a speculative/risky environment. It is important to understand the incentives of the Fed and impact on the financial system and pricing.

“Acknowledging what you don’t know is the dawning of wisdom.” – Charlie Munger

“Remember that just because other people agree or disagree with you doesn’t make you right or wrong -- the only thing that matters is the correctness of your analysis and judgment.” – Charlie Munger

We want the market to agree with us….but later.

Truisms

The 5 big destroyers of capital are 1) Inflation; 2) Taxes; 3) Misbehavior (overtrading, excessive fees, performance-chasing, leverage, etc.); 4) Misallocations (bad investments, too much risk, etc.); and 5) Catastrophic loss.

The math of investing is asymmetric. If you are down 33%, you need to be up 50% to break even. If you are down 50%, you need to be up 100%. Therefore, avoiding large losses is the best way to maximize your compounded returns.

There are only three conclusions with respect to every investment: ‘Yes’, ‘no’ and ‘too hard’.

There are only three possible actions with respect to every investment: ‘Buy’, ‘Short’ and ‘Ignore’.

If markets were predictable, trillionaires would exist.

Most of a stock’s movements, including declines, are normal variability and not worth spending any mental energy on. Much more important is to identify investments that don’t carry heavy risk of a permanent loss of capital. That means avoiding future bankruptcies and avoiding overvalued investments.

Wall Street is a caveat emptor system. It doesn’t make sense for investors/retirees to be served by a firm that promotes investments or uses sell-side research, rather than a firm that develops its own independent research and approaches every investment with a high degree of skepticism.

Pricing power matters in business.

One of the best outcomes of rising rates is that government interest payments will take up such a larger percentage of their budgets, which, in turn, will force a shrinking of wasteful expenditure, subsidies and heavy interventions. This will transition the economy to become more market-based, which is healthy because people will then produce, innovate and become more independent.

Wall Street’s job is to put lipstick on a pig and try to convince you it’s Miss America. Lyft, Peloton, Beyond Meat are prime examples. Wall Street and their financial media partners promote garbage businesses to their retail clients and on CNBC, knowing full well they are garbage…then they decline 90% and you never hear about them again. It’s a massive transfer of wealth from the hands of many to the hands of a few Wall Street promoters.

Because of loss aversion and periods of excess leverage, markets, on average, go down twice as fast as they go up.

Capital Appreciation Strategy

We generally invest our clients’ accounts in one of two specific strategies. Each has its own unique advantages and disadvantages, but the overall goal is to earn high average returns without incurring a permanent loss of capital. We do this by investing in what we believe are underappreciated/underpriced securities trading at prices below what they are worth.

Depending on account size and preference, we use a variety of investment types to fulfill each strategy. For smaller accounts we might use a combination of mutual funds and/or ETFs, and for larger accounts we will likely use mostly individual stocks.

Capital Appreciation Strategy

The goal of the Capital Appreciation strategy is to earn high returns in a disciplined, patient manner. We want to do our homework and avoid overpaying. That way, when the next bear market comes along, we can stay the course and wait for temporary price declines to recover. We may well add to our positions if we believe great businesses are on sale at attractive discounts.

Desired Attributes – We seek investments in companies that are inventive, adaptable, dominant and/or have a realistic probability of generating outsized returns for shareholders over time. Over time, such businesses commonly generate appreciation by multiples of the initial investment, and such gains enjoy favorable taxation in taxable accounts. These companies often share certain key traits:

- a clarity of mission

- huge addressable markets

- management that balances the interests of all stakeholders and, most importantly,

- a sustainable competitive advantage

These businesses are admittedly rare, but the potential long-term rewards are substantial.

Value – Our research process concentrates on one critical question: “What is this company worth?” To answer it, we must first develop a comprehensive understanding of the business -- the key ingredients (the intangibles) that make for successful investing – the “moat” that the business has, how well management stewards shareholder capital, and how risky are its long-term prospects. The bulk of any company’s value is determined by its future prosperity.

Conservatism/Margin of Safety – We look to build a margin of safety into our purchase price. We start by using a reasonable set of assumptions in our financial projections. Then we bolster that margin of safety by employing a challenging hurdle rate—a relatively high expected return over time. A challenging hurdle rate reduces the initial purchase price that we are willing to pay, which hopefully results in an acceptable return even if our growth assumptions prove faulty.

Dividend Strategy

We generally invest our clients’ accounts in one of two specific strategies. Each has its own unique advantages and disadvantages, but the overall goal is to earn high average returns without incurring a permanent loss of capital. We do this by investing in what we believe are underappreciated/underpriced securities trading at prices below what they are worth.

Depending on account size and preference, we use a variety of investment types to fulfill each strategy. For smaller accounts we might use a combination of mutual funds and/or ETFs, and for larger accounts we will likely use mostly individual stocks.

Dividend Strategy

A substantial portion of shareholder returns have been derived from dividends. Our Dividend Growth strategy invests in companies that pay their shareholders dividends—and can grow those dividends, primarily through pricing power and a well-executed corporate strategy.

The benefit of investing in a strategy that generates a growing stream of dividends is that it somewhat mitigates the impact of market volatility, timing and risk. Our clients (shareholders) should continually receive a stream of cash from their portfolio and own shares of great companies that have the potential to appreciate in price over time.

Desired Attributes – We look to invest in companies that are stable, mature, dominant and that earn high profits and pay out cash dividends with a capacity to grow them. These companies often share certain key traits: management teams that allocate their capital in a disciplined way, a thoughtful corporate strategy, and strong underlying fundamentals. This is about much more than just current yield — these investments must offer appreciation potential and be able to grow their dividends. We generally avoid investments with depleting assets.

Value – We apply the same valuation methodology to the Dividend Strategy as we do to the Capital Appreciation strategy. It is important to note, however, that one benefit of dividends is that they are true cash taken in by the company and paid back out to the shareholders. Dividend payments cut through and eliminate many accounting shenanigans that companies can employ to overstate their earnings, so in general, dividend-paying stocks carry a bit less accounting risk than non-dividend payers.

Conservatism and Margin of Safety – We seek a margin of safety in the stocks of the Dividend Strategy, but dividend paying stocks can be sensitive to interest rate changes. We seek companies that will thrive and be able to support and increase their dividend in a rising rate environment.

It is interesting to note that over an extended period, stocks that initiated or increased their dividends outperformed other stocks with no dividend policy.

Only companies that pass our rigorous value criteria make it into the Townsend Dividend Strategy. The Townsend investment team chooses companies—or eliminates them—following careful evaluation of each company's:

1 Dividend track record and capcity to grow dividend in the future;

2 Ongoing business performance and how well it meets the Townsend standards; and

3 Stock price and the discount where it trades versus Townsend’s measure of intrinsic value.

Our sophisticated stock selection approach coupled with thorough ongoing oversight creates a strategy with low investment turnover. It is designed to help you achieve your financial objective of receiving cash and participating in long-term appreciation.

*Please Note: Limitations. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Townsend & Associates, Inc.) or any planning or consulting services, will be profitable, equal any historical performance level(s), or prove successful.

Fixed Income

To meet anticipated cash needs, to buffer from potential volatility of your account balance, provide interest income and to invest within your comfort zone, we usually recommend allocating a portion of your assets to fixed income investments, or bonds.

Our fixed income positions are comprised mostly of diversified investments and cash equivalents, with the specific mix determined by market environment and account size.

In managing this portion of portfolios, we strive to add value in four distinct ways:

- Opportunities along the yield curve;

- Diversification across sectors;

- Improving credit situations; and

- Relative currency values.

We examine a broad set of macroeconomic factors, including developments affecting major sectors of the global bond markets, and we leverage independent research and incorporate a variety of perspectives to try to position opportunistically, but with a bias toward minimizing exposure to capital losses.

This analysis, coupled with our interest rate assessment, shapes our market perspective and guides our positioning within government, corporate, mortgage, agency and asset backed sectors across both domestic and international bond markets.

Market Commentary

Most Recent Article

Parimutuel in Perpetuum - Summer 2024

Links to Archived Articles

Munger, Markets and the Magnificent 7 - Winter 2024

A Tale of Two Markets - Summer 2023

Bank Bailouts and Moral Hazard - Spring 2023

The Importance of Avoiding Large Losses - Winter 2023

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Townsend & Associates, Inc. (“Townsend”), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Townsend. Please remember to contact Townsend, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Townsend is neither a law firm nor a certified public accounting firm and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Townsend’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.

Investment Webinars

Each quarter, Townsend aims to host a live webinar for clients regarding the current investment markets and other economic updates. If you cannot join us for the live webinar, we will post the recorded webinar on this page. Click the image below to watch the recorded webinar. Click the icon on the bottom right of the frame to make the video larger.

Q3 2024 Market Update with John Goltermann

July 30, 2024

John's Q3 update will touch on 2nd quarter market action, a look ahead, an economic assessment, and a geopolitical update.

Q2 2024 Market Update with John Goltermann

April 23, 2024

John's Q2 update will touch on 1st quarter market action, a look ahead, an economic assessment, and a geopolitical update.

To download the audio only for this webinar,

Q1 2024 Market Update with John Goltermann

January 23, 2024

John Goltermann, CFA, CGMA, talks about Q1 investment markets, the opportunity set and the important factors at work. 2023 was an unusual year, and John explains the price action in stocks and bonds, what was behind it, and what to look out for going into next year.

Market Updates Webinar with John Goltermann

October 25, 2023

As the job market has cooled, Covid-era savings have run down, inflation remains elevated and a hot war has begun in the Middle East. Investors are naturally concerned with what the future might have in store for them — especially after a year when only a handful of popular investments have traded significantly higher. In this presentation, our chief investment officer, John Goltermann, CFA, CGMA takes us through some of the important factors at work that will likely affect returns going forward, and tries to distill it down to reasonable positioning for today’s challenges. While many advisory firms get caught up in trying to beat the S&P 500, we focus on preserving our clients’ capital and purchasing power as market prices adjust to higher interest rates and an increasing risk environment with many crosscurrents.

Market Updates Webinar with John Goltermann

May 2023