October 2023 Crosscurrent Market Update

“The stock market is a device for transferring money from the impatient to the patient.” – Howard Marks

Crosscurrents

by John Goltermann, CFA, CGMA

Some of the recent developments in markets conflict with each other and are worth examining. Crude oil prices have rallied strongly despite softening global economic data. Stock prices have remained buoyant despite rapidly rising interest rates over the last 3 months, (from 3.75% to 4.25% on the 10-year Treasury and from 6.5% to 7.2% on mortgages). Inflation has remained sticky despite the Fed’s efforts to control it.

There are distinctive reasons for all these crosscurrents. For example, the rise of crude oil prices has resulted from supply challenges due to policy decisions, geopolitics, and production issues. Energy prices affect the price of just about everything that is physically produced and delivered, so inflation has persisted. Stock market liquidity has remained strong because financial conditions have continued to ease in the face of rising rates, which in turn have kept stock prices up. Interestingly, the rally in the S&P 500 through the first half of the year was limited, mostly, to a handful of large tech stocks that have generally been flat since June.

Stock price volatility has declined overall in the last quarter as investors, in aggregate, appear to be anticipating a so-called “soft landing” in the economy. A soft landing would mean continuing economic growth and declining inflation. This remains to be seen.

Making accurate predictions from past performance is a myth

One of the investment lessons I learned early in my career is that past returns do not predict future returns. In fact, the most recent returns often predict the opposite return over longer periods of time. This is a reality that the investment industry generally does not talk about.

If past returns predicted future returns, Beyond Meat, Lyft, Teledoc, Zoom and Peloton would probably be worth around 100 times more than they are today, instead of being down significantly from their highs. The Janus Global Technology Fund would be up 10,000-fold after its tripling in 1999 instead of being down 80% over the ensuing 18 months and trading at a loss for 20 years after its year 2000 net asset value. Excitement and return-chasing (buying stocks whose prices have recently risen) is common behavior among both individual and institutional investors, but it does not work. It is important to be skeptical of today’s winners because they can be the worst investments.

Some stock prices are driven higher for no good reasons other than hype, career risk, and herd behavior. Many professional investors fear not owning hot stocks and, God forbid, underperforming a benchmark. Accordingly, their decisions often have nothing to do with the quality of a prospective investment, its long-term prospects, or the value of the business itself. In the short run, the price of an investment reflects human emotion, behavior, incentives, and biases. And we humans are fickle. But for those investors who are able to have a long view and use time to their advantage, these mispricings create risk and opportunity.

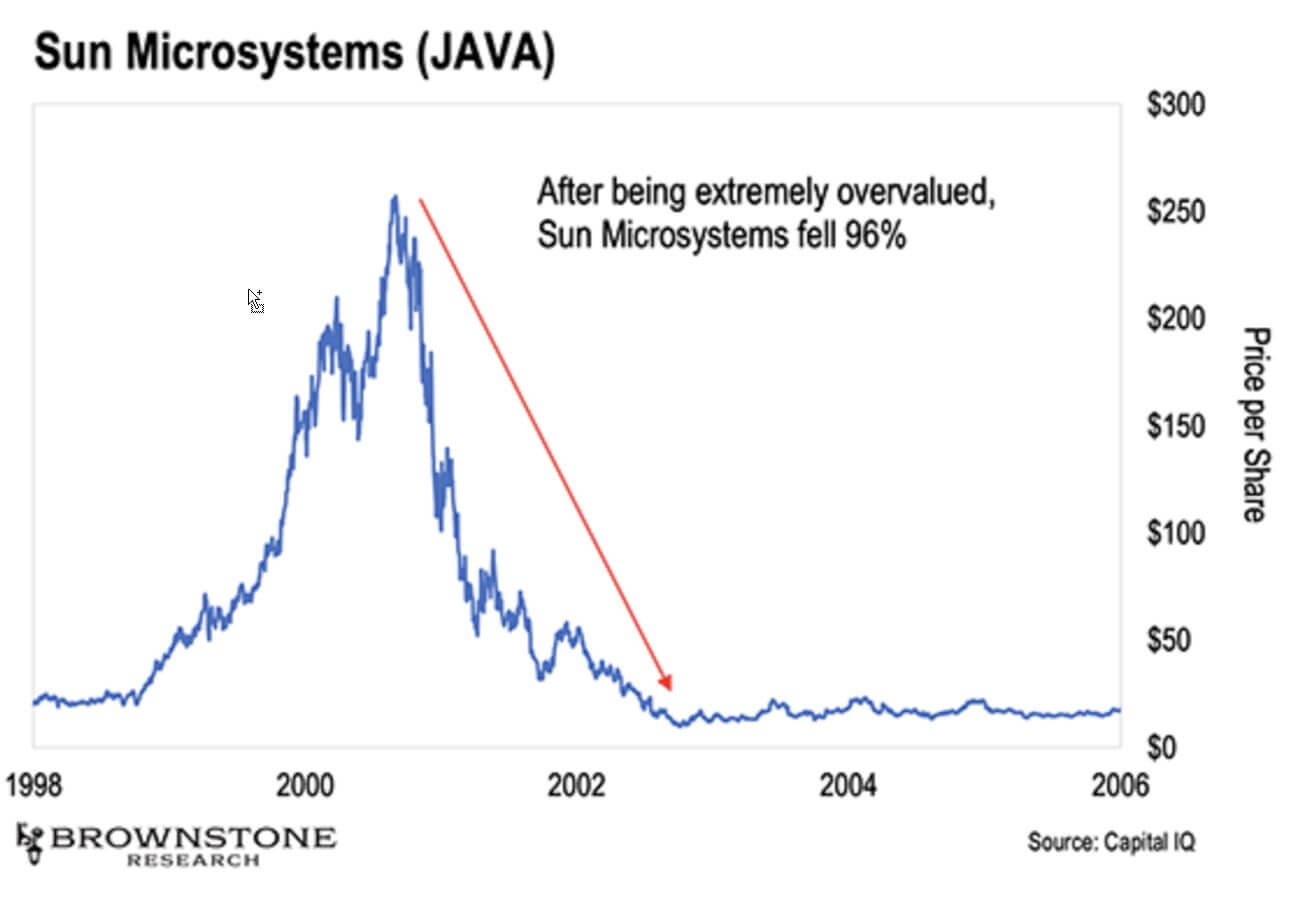

A 90’s bubble examination

I remember the late 1990s when Sun Microsystems and Cisco were the “hot stocks”. Professional money managers “had to” own them because they were large index constituents, and if you didn’t own them and your performance lagged in a rising market, you might lose business. Today, money managers “have to” own Nvidia, Apple, Google, etc. because there is little tolerance for “underperforming.” So those stocks are widely held, trade at very high prices and carry significant risk. Moreover, money pouring into the S&P 500 drives the prices of its largest constituents higher, but that capital is largely invested without regard to risk or price. In my opinion, realistic values of those businesses do not support their current stock prices.

Sun Microsystems and Cisco were on the forefront of technology development in the late 1990s -they were spoken of constantly on CNBC (and other financial media) and had performed spectacularly. Everybody talked about them all the time. But precisely at the peak of their popularity, they were terrible investments. Unfortunately, that is often how markets work.

A feature of every bubble is that many investors lose touch with reality. This environment is no different. Take the unprofitable Vietnamese electric vehicle maker, Vinfast Auto, as an example. In August, the company was valued by markets at $200 billion -more than Boeing Goldman Sachs; and GM and Ford combined. VinFast had produced 19,000 cars at a loss. This type of delusional pricing based on hype is commonly seen in bubbles, and, in VinFast’s case, it is a product of very few shares being publicly available, combined with institutional ESG mandates,(socially responsible investing) and a clamor for any investment that checks ESGboxes.

Contrary to renowned strategists such as Jeremy Grantham, I do not believe that there is a bubble in everything. Gold mining stocks, for example, trade at depressed prices relative to their likely value. Many stocks, in fact, trade at attractive levels. But the so-called ‘Magnificent Eight’ stocks trade at extremely high levels relative to their profitability and a realistic estimate of their future growth. The point is this: Wall Street promoters are still able to whip up performance-chasing behavior that, in turn, runs up the prices of more speculative investments to unrealistic levels.

Complacency in high-rate environments is not advised

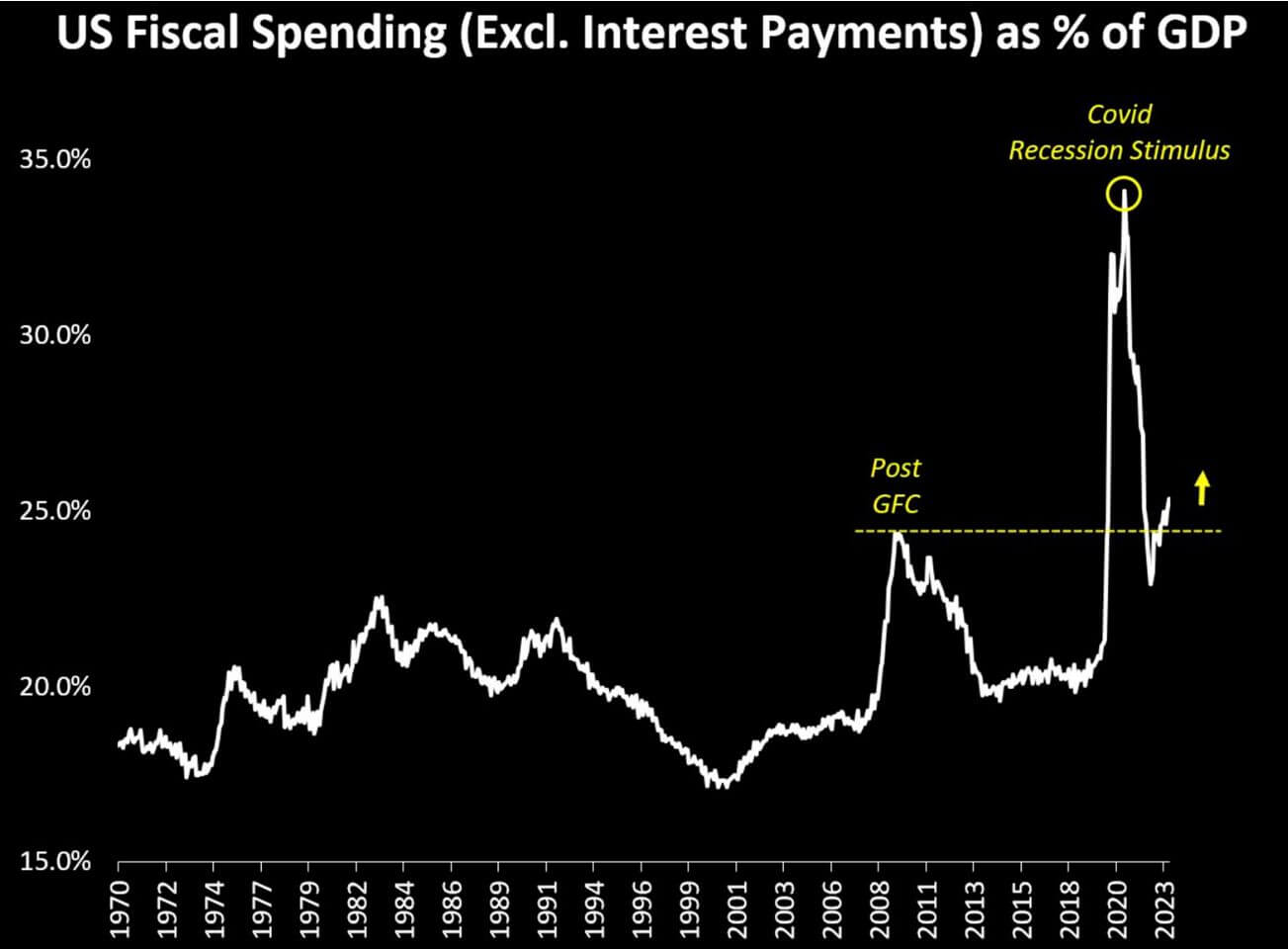

Going forward, we still must invest in an environment of much higher interest rates but one where many assets still carry the prices created by a low-rate environment. And in one of the most important crosscurrents and ironies of all, the Federal Reserve is combating inflation while Congress itself is contributing to it through record spending and fiscal deficits, (see chart below). In fact, fiscal spending is higher now than it was after the great financial crisis of 2008.

Considering these reasons, it makes sense to stick with reasonably-priced investments and to avoid excessive risk. Risk comes with too high prices. We also look for solid fundamentals–good quality assets, manageable debt, and strong corporate governance. With Townsend, our goal is to earn you high returns on your investment dollars while avoiding large losses that can come from overpaying. Large losses significantly lower your average return. Investors who chase returns and don’t care about the prices find this out the hard way.

That said, we invest in public markets where prices are set by other investors and speculators. No matter how well we do our analysis, price declines are an inevitable and normal part of the investing experience. This is also true for bonds, which is why we have kept maturities mostly short and quality high.

The team at Townsend Retirement thanks you for your trust and your referrals. Protecting the financial well-being of our clients is the essence of our business. We promise to work hard to make good decisions on your behalf and we encourage you to speak to your advisor if you have any questions about investments, personal finances, or anything else.

We look forward to hearing from you soon.