March 2024 Muscle Memory

“Mimicking the herd invites regression to the mean.” – Charles T. Munger

Muscle Memory

by John Goltermann, CFA, CGMA

In the 1st quarter of 2024 the same dynamics were at play as during the 4th quarter of 2023. Financial conditions were easy amidst rising home prices, stock prices stayed buoyant, and the official rate of inflation eased. Stocks trended upward due to the ‘muscle memory’ of passive, quant and algorithmic investors that mechanically dump money into index funds and programs. It is ‘muscle memory’ because this large cohort of investors all do mostly the same thing, react the same way to the same data and buy the same stocks. For now.

The economy also has remained resilient — defying many of the doomsayers’ predictions of a recession. The majority of gains in stock prices, however, were largely concentrated in a handful of mega-cap tech stocks. Narrow leadership like this, where just a very few positions carry the market higher, argues for continued conservatism in an investment approach.

Why?

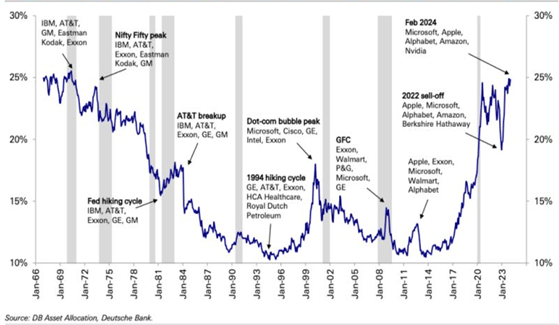

Markets with very narrow leadership have often been seen to precede strong bear markets. This is not a prediction or a warning, but rather a case for us to continue paying attention to risk. The following chart shows the level of concentration of the top 5 companies (as a percent) of the S&P 500 through time. It illustrates that the current combined weighting of the top 5 stocks in the S&P 500 has approached that of the famed “Nifty-Fifty” era of the late 60s-early 70s. The Nifty Fifty refers to the large companies that dominated the indexes at that time that investors believed could be bought regardless of price. That belief was false and those stocks dramatically underperformed for a long time because they simply became significantly overpriced. Price does matter.

A Look to the Past

The narrow leadership of the post-2008 crisis, currently called ‘the Magnificent 7’, has been extraordinary. But the history of rallies led by a handful of companies suggests that special attention should be paid to changes in trend because the ensuing bear markets have been harsh. I am not trying to make a case that today’s level of concentration is unprecedented, or that things are about to fall apart. Markets have indeed been concentrated before, if not more concentrated. And conditions can remain stable for a while.

But it is important to remember that the “Nifty-Fifty” era I mentioned before was followed by the punishing stock markets of the 70s. The Internet Bubble at the turn of the century, also led by a handful of stocks of technology companies, resulted in an over 80% decline in the NASDAQ index (composed of mostly technology stocks) and a tough broad-based bear martket in the early 2000s. The rally that preceded the 1929 market crash was heavily concentrated in radio and a relative handful of other companies. In the 19th century, narrowly led bull markets concentrated in canal and railroad shares were also followed by sharp market downturns.

Things Have Changed

Many things, of course, are different now. The Federal Reserve intervenes regularly with a heavy hand to create liquidity. It even buys securities outright to prop up prices. Market structures too have changed: Huge amounts of capital are allocated to so-called ‘passive investments’, which track indexes – the S&P 500 being by far the most popular. Passive investments now represent 53% of total invested assets, up from 10% in the year 2000 . And when passive investments are wildly popular, by definition, the most money automatically goes into the largest stocks. Passive investors care little about price.

David Einhorn, the CEO of hedge fund Greenlight Capital says that because of the dominance of passive and ‘quant’ investors the market’s pricing mechanism is “fundamentally broken.”

A Deeper Look at Passive Investments

The popularity of passive investments is understandable. They offer low fees, an ability to gain diversified exposures and are tax efficient. They are easy to implement, super-liquid and intellectually undemanding. Also, 80% of actively managed mutual funds have historically underperformed broad market indices – further contributing to their appeal, (there is a reason that explains this but it is beyond the scope of this article).

But great results in anything are rarely achieved by being “passive.” Of course, that is true in any aspect of life whether it is relationships, careers, health or our investments. The ease of use of passive vehicles has reduced the desire by many people, including many investment professionals, to acquire investment knowledge obtained by study and experience. Passive investments, therefore, have created a large pool of investors with limited skills in coping with adversity or adapting to a changing opportunity sets.

The experience of most passive investors has been a march higher since 2000 as the Federal Reserve has squelched market volatility through suppressed interest rates, quantitative easing and money printing. And passive investments have grabbed an increasing share of stock investments. Thus, confirmation bias, recency bias and complacency have set in.

What is confirmation bias? It’s a human tendency to pay attention to data and opinions that only support existing views. What is recency bias? It is the tendency to put excessive emphasis on experiences that are most recent in your memory. These are psychological traps that lead people astray, but are difficult for many to overcome. As such, they are extremely important to understand and be aware of. Superior returns in indexes in the recent past have created both confirmation and recency biases that indexes must be superior. Increasing adoption of this belief has created herd behavior. And herd behavior has created risk. That is where we are.

The Impact

How will passive investors respond to large declines associated with bear markets when they inevitably arrive? Instead of looking at price declines as a source of long-term opportunity, investors with modest experience and negative returns may be more prone to emotion-driven decisions. And this could easily create greater downside risk for both the passive investor and capital markets in general – making investing with a ‘margin of safety’ hugely important.

Since investors do not deal in certainties they are better served by spending time understanding pricing and risk. Making predictions is futile. It is important to see today’s era as an array of prospective catalysts that could produce adversity and market volatility. Stock market valuations and investor optimism are at very high levels. The global economy is burdened by an unprecedented level of debt, geopolitical turmoil is rising, and the risk of recession has increased.

Recessions often begin – seemingly – out of the blue when economic activity falls enough to set in motion adverse feedback loops that cause unemployment to rise. Right now, households have run out of excess savings and default rates on credit cards and auto loans are skyrocketing. All at a time when the S&P 500 is super-concentrated and trades at a large premium to fair value. This is why we seek investments with a margin of safety and in great companies that are reasonably priced. The media-hyped speculations of the recent past, such as Nvidia, that are up 10-fold in a short period of time can easily trade down 90%.

The most sensible approach to this type of environment, in my strong opinion, lies not in passive investing, but in investors becoming more engaged and more active in the management of their financial resources. The effort to become a better informed, more active investor will reward, not only to those who choose to make their own decisions, but those who prefer to have their investments managed by others because it will improve their ability to ask well-informed questions. In our business, we enjoy engaged clients.

Here at Townsend, we spend a lot of time on our investments and believe we own investments with high upside and low downside. From year-to-year, we can’t know how other people will price them, but all possess the ingredients for higher prices — later. We try to apply the lessons of Buffett and Munger in the effort to earn you high returns without exposure to the large downside risks that so many other investors unwittingly own today.

If we can answer any specific questions about what is currently happening in the market and what that might mean for you, please don’t hesitate to reach out to us.