Investment Framework

What we do is not rocket science. It is work. It isn’t conceptually difficult to understand. It is, however, difficult to do well. There is no formula, algorithm or process that ensures success – just hard work and attention to factors that matter.

Investment results and the risks that your investments carry have a huge impact on your financial, personal, and mental well-being. Accordingly, Townsend takes the business of investing very seriously, with the dual goal of preserving your capital and earning the high returns available in equities. We focus on value, as well as the factors that will likely influence your investments. And because times change, we also want to understand the broad investment backdrop and risk environment.

One of the most important elements of investment success is a workable and sensible investment philosophy that is applied consistently. Many professional investors and traders can operate without an investment philosophy and are either 1) short-term oriented and trade often; or 2) they give you an investment portfolio that looks like a benchmark such as the S&P 500 (called closet-benchmarking); or 3) they overdiversify their clients. Accordingly, they trade too often in the hopes of making a quick profit, or they are happy to give you a market return. We believe strongly that you deserve better.

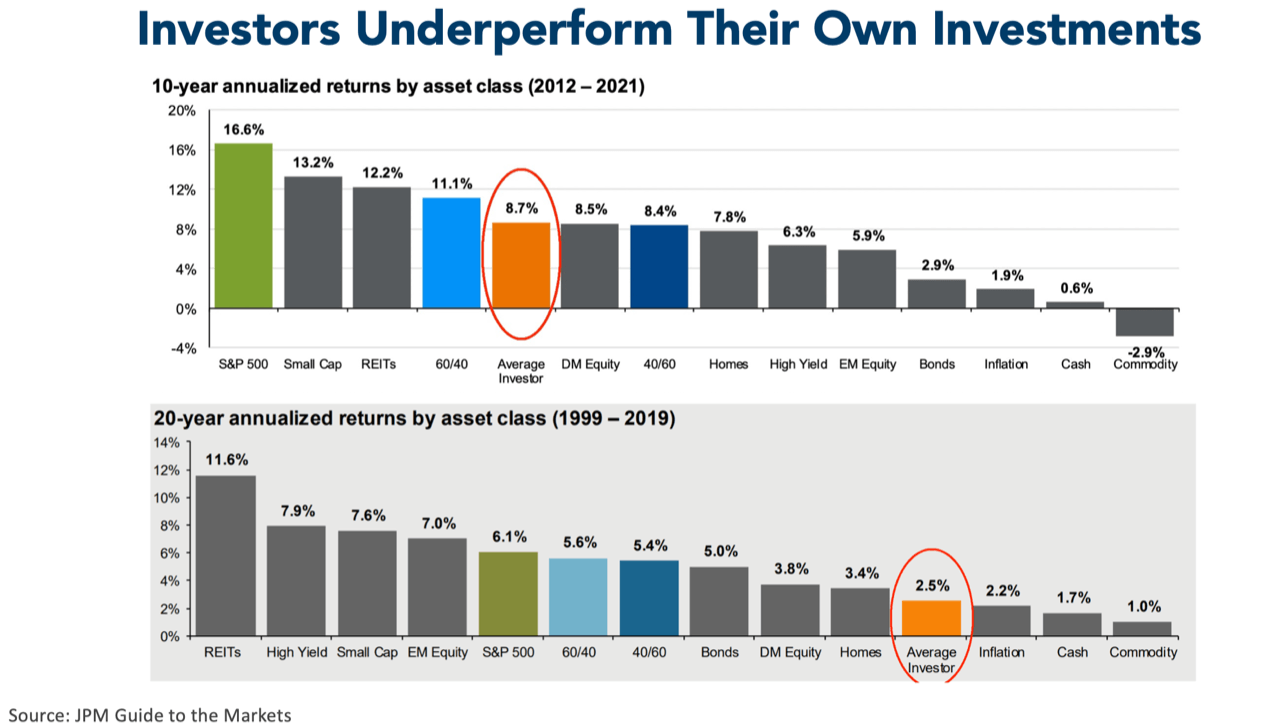

As the chart below shows, neither trading often nor closet-benchmarking gives you high long-term returns or reduces risk. A long-term oriented portfolio of well-researched investments can give you high returns with low risk.

Why do most investors fare so poorly? Because performance chasing, buying ‘popular’ investments and market timing do not work. Imagine driving in traffic. On a highway full of cars some will constantly change lanes to try to get where they are going more quickly. But in traffic, as in investing, changing lanes doesn’t get you there faster. It gives you an illusion of going faster. And in the end all it does is create more risk of an accident. Similarly in investing, investment advisors can chase popular stocks that have risen in price in an attempt to outperform their peer group. This is what famed investor Seth Klarman calls the “performance derby”. The performance derby can induce advisors to take excessive risks and, because past price moves do not predict future price moves, it might not work out well for their clients.