December 2023 Munger, Markets and the Magnificent 7

“It’s so simple. You spend less than you earn. Invest shrewdly, avoid toxic people and toxic activities, and try and keep learning all your life. And do a lot of deferred gratification because you prefer life that way. And if you do all those things, you are almost certain to succeed. And if you don’t, you’re going to need a lot of luck.” – Charlie Munger

Munger, Markets and Magnificent 7

by John Goltermann, CFA, CGMA

Charlie Munger passed away on Nov. 28, 2023 at age 99 — 34 days short of his 100th birthday. Probably best known as Warren Buffett’s business partner in the world’s greatest compounding machine, Berkshire Hathaway, Charlie was one of the greatest minds of the 20th century. His observations and ideas have had a profound impact on me.

According to the Wall Street Journal, Munger possessed what philosophers call epistemic humility, which is a profound sense of how little anyone can know, and how important it is to be open to changing one’s mind. He was a fiercely independent intellectual who, in the words of Buffett, “Marches to the beat of his own music, and it’s music like virtually no one else is listening to.”

When asked the secret to his success, Munger answered, “I’m rational.” He was a voracious reader and drew from his study of psychology, economics, physics, biology, and history in developing a system of multiple mental models to cut through the difficult problems of complex systems. Adopting this approach to thinking is difficult but using its core tenets helps provide clarity and maintain objectivity – both being super-important for investors.

There are too many great Munger quotes to include in this article but they are all available online with a simple search. Poor Charlie’s Almanack – a collection of Munger’s talks and speeches –is worth reading if you’d like valuable investment insights without mathematical models. The best description of Poor Charlie’s Almanack is it is a compilation of uncommon sense and brilliant insights with logical simplicity.

A Recent Market Look Back

After three months of declines, stocks saw a broad-based bounce back in November and December. The reasoning appears to be mostly related to a continuing moderation of inflation, along with the belief that central banks are done raising interest rates and in fact, may be heading to cuts. Not surprisingly, the Magnificent 7 (Apple, Google, Microsoft, Amazon, Meta, Nvidia, and Tesla) led the rally

As of this writing, 1.25% of rate cuts are expected by Fed funds futures traders by the end of 2024. The yield on the 10-year Treasury has also declined significantly, from 5.00% at the end of October to 4.00%. This reflects some growing worries about the strength of the global economy that has caused bonds to rally, and stocks have followed suit. There are also some signs that the labor market is weakening, as continuing unemployment claims are now at the second highest level since November 2021. Plus, private sector job growth is now 130,000 versus the 2022 monthly average of 376,000.

Impact to Interest Rates

But in the longer run, many other factors will contribute to the future level of interest rates. The massive amount of public debt must be financed by an ever-growing increase in the issuance of Treasuries, which now have fewer buyers than they used to. And paradoxically, if the labor market continues to soften, it’s highly likely that budget deficits will expand even more to fund-growing unemployment claims and expansion of government benefits. As Treasury issuance (supply of bonds) grows, it will put upward pressure on interest rates.

Right now, with a growing economy and full employment, the Federal government is running a $2 trillion annual budget deficit. Interest expense alone on the existing debt will be around $745 billion for fiscal 2024 according to the Congressional Budget Office, which is on par with the Department of Defense budget. High debt levels are a risk and have a negative impact on the economy and markets.

Central bankers may be hesitant to cut rates absent any meaningful slowdown in the economy because the current high levels of fiscal stimulus is inflationary. The Fed went all-in when it came to easing monetary policy in response to COVID-19 but were very slow to reverse course, which is partly behind the 2022 40-year inflation high. Despite inflation now being down, the battle is still not over. Keeping it down will be a challenge. We still face inflationary pressure from deglobalization, wars, trade friction, poor health of the labor force, demography, environmental policy, government spending, and crime. Therefore, it’s possible that stock prices – especially among the most popular stocks – are ahead of themselves at this point.

Understanding Financial Conditions

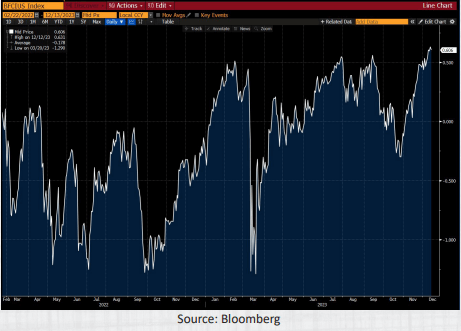

Probably the most important chart to explain stock prices in 2023 is this one:

This shows the financial conditions index for the last two years and, as you can see, financial conditions have loosened throughout 2023 to a new high – despite some bumps along the way. What does financial conditions measure? Broadly speaking, financial conditions measures stress in financial markets. It’s an amalgamation of things, such as equity prices, interest rates, credit spreads, the US dollar, price volatility, and other variables. Loose financial conditions indicate low stress.

The thing about financial conditions, however, is that it has limited predictive value and can change on a dime. Any upside surprise in the inflation statistics, downside surprise in employment numbers, geopolitical or credit events can cause conditions to tighten quickly. Tightening conditions can have a negative impact on markets.

Had we known with certainty a year ago that financial conditions would ease significantly in 2023, (despite rising interest rates and tight monetary policy), we, of course, would have positioned differently. In fact, we probably we would have loaded up on speculative stocks.

That said, it would have been imprudent for us to do so because the valuations of speculative stocks are still astronomically high relative to sales and earnings, and valuations do matter. We will not play musical chairs with our clients’ money. We know that we do not know the future, and the future is often very different than what we think it will be.

Even though stocks were generally up, returns were bifurcated in 2023 between the cultish Magnificent 7 stocks, which are up a lot, and everything else, which are only up slightly. Stocks are broadly only back to where they were two years ago. And it didn’t matter if you were in growth or value stocks over that two-year period. Value stocks were down a little in 2022 and up a little in 2023. Growth stocks were down a lot in 2022 and up a lot in 2023. For the most part stocks are right back to where they started in December 2021 in both styles. Even the Magnificent 7 are mostly back to where they were at the end of 2021. In 2022 they were down 40% – 70%, and in 2023 they were up 50% – 230%. Same same.

The Magnificent 7 are similar to what was referred to as the ‘Nifty Fifty’ in the 1970s, which were stocks of large dominant companies and top-index constituents. Then, it was thought that they could be bought without regard to price – ‘price’ being the relationship of the stock price to sales and earnings of the company. That proved not to be true and the Nifty Fifty stocks ended up being poor investments.

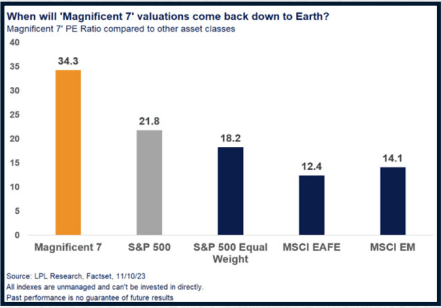

We have continued to not own the Magnificent 7 simply because they do not present great values in relation to profitability and their likely future growth rates. And owning things that are wildly popular at the moment and trade at expensive levels, (see above price-to-earnings ratios) has proven to be a losing strategy for long-term investors time and time again.

The more recent decline in rates along with a stock rally reflects increasing hopes that the Federal Reserve will be much more accommodative going forward, but even if it is, that is not necessarily super bullish for growth stocks, (which have already rallied). Any cut in rates from here will likely be modest because of the aforementioned inflation pressure, and those rate cuts would likely be in response to an economic slowdown or recession.

The other thing people have forgotten is that Fed policy (with increasing interest rates) acts with a 12- to 18-month lag. Actually, it may be a longer lag because when rates were super-low, most people and businesses refinanced debt at low levels and the re-financing cycle hasn’t kicked in. So, the economic effect of increasing rates has not been seen yet because the effective Fed Funds rate in July of 2022 (18 months ago) was 1.7%.

If we are indeed at the end of an era of easy money, stock valuations will matter a lot. Investors and traders will be much more discerning and rational in how and where they invest their capital. Today’s speculative euphoria will likely fade and capital should come back to companies that are making money and that have valuable, enduring assets.

Applying Munger’s Learnings for the Long Term

It is important to remember that investing is interpretive. Two different people can look at the same set of data and form completely different perspectives. Being interpretive is what makes investing more art than science. Two investors may also have completely different motivations. One might be long-term oriented and trying to protect clients from big risks like high valuations, and one might not care about risk at all because he/she is paid for short-term returns. This is why it is impossible to predict how human beings will interpret and react to future data, let alone what that data will be. The best a long-term investor can do is to own good risks and avoid bad ones. Charlie Munger understood this.

Munger said, “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” Buffett said, “Rule Number 1 is don’t lose money. Rule Number 2 is don’t forget Rule Number 1.” They weren’t talking about normal price variability; they were talking about suffering a permanent loss of capital, which comes from overpaying.

Here at Townsend, we have spent a lot of time on our investments and believe we own good long-term risks with high upside and low downside. From year to year, we can’t know how other people will feel about them or how they will be priced but all possess ingredients for higher prices, later. We try to apply the lessons of Buffett and Munger and, while we probably won’t earn the 2,000,000% (20,000:1) return that Berkshire has over its 58-year tenure, we believe that we can at least help you earn high returns without exposing you to the risks that so many other investors are making today.

If we can answer any specific questions about what is happening in the market and what that might mean for you, please don’t hesitate to reach us.