August 2023 Back to School

“Investing is a popularity contest, and the most dangerous thing is to buy something at the peak of its popularity. At that point, all favorable facts and opinions are already factored into its price, and no new buyers are left to emerge.” – Howard Marks

Back to School Markets Update

By John Goltermann, CFA, CGMA

August 14, 2023

Investors could really increase their chances for success by applying lessons from some of the best investors of all time. Howard Marks is one of them. Charlie Munger, Stan Druckenmiller, Warren Buffett and Seth Klarman are a few of the others. Two common themes emerge from their observations about successful investing:

1) The importance of temperament

2) The ability to be skeptical of what the “crowd” is doing.

Howard Marks stated it best when he said, “You can’t do the same things others do and expect to outperform.” Included at the end of this piece are more of Marks’ notable quotes.

It has been a quiet summer so far. Apart from Fitch’s downgrade of US government debt and Moody’s downgrade of a big chunk of the banking sector, it has been mostly drama free. However, these developments do highlight more significant long-term issues. Stock prices have drifted higher over the last few months but during the month of June, the rally broadened out from its narrow leadership of mega-cap tech companies to include most stocks. The equally-weighted S&P 500 is now up around 9% since May 31.

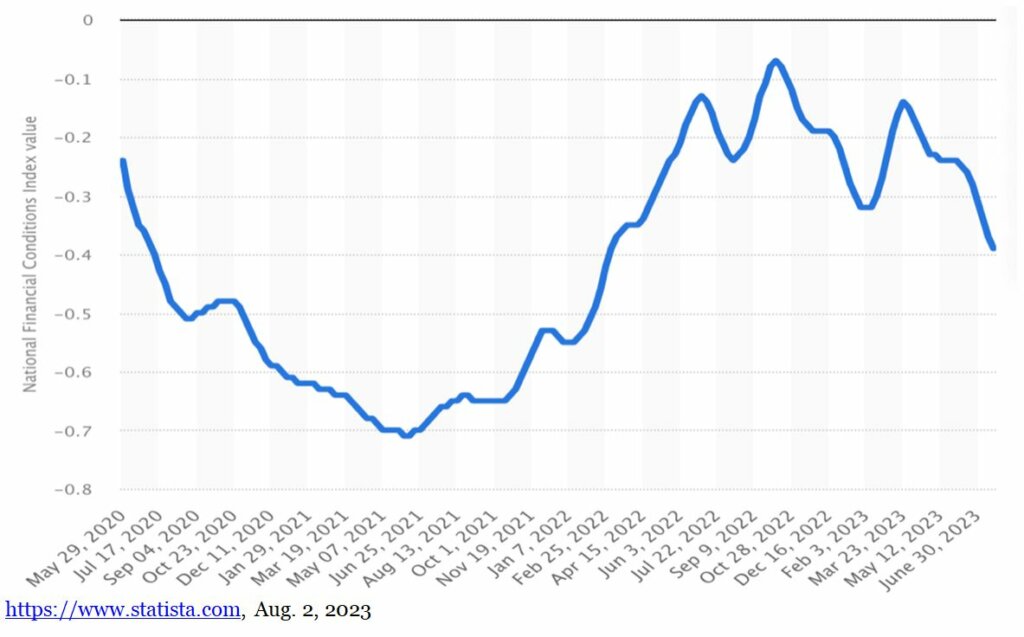

Interestingly, this happened amidst rising interest rates. The 10-year treasury yields traded up from 3.65% on May 31 to 4.21% as of this writing (August 14). Ordinarily, rising rates are bad for stocks but financial conditions have eased,(see below and note: a declining line depicts easing conditions). Factors that can ease financial conditions include rising stock prices, rising home prices, declining interest rates, tightening bond spreads (yields over Treasuries), declining dollar, and declining energy prices.

Two beliefs on what’s ahead

Financial conditions are interesting for explanation but have limited predictive use. For the future, there are two primary schools of thought on how things will go. One is the belief that the economy currently has all the elements and signals to pull off a soft landing. This is what the consensus now believes and has mostly priced in. The other school believes that the soft-landing scenario is a lower probability than what is currently expected and that recessions are unpredictable. In fact, recessions and difficult markets tend to hit right at the moment the consensus believes they are not coming. This happens to be what I believe.

Look out, not down

There is no way to know for sure; everyone is out there guessing. Market prices do not move in a straight line. Traders react to headlines and those reactions cause follow-on reactions. What we do know is that debt levels are high and probably due to interest rates, (the cost of credit)being suppressed by the Fed for a long time. We know that interest rates has risen significantly. We know that COVID policies caused dislocations. We know that many institutional investors are restricted from investing in traditional energy sources. We know that technology stocks have dominated returns over the last 14 years and now comprise 38% of the S&P 500. We know that markets eventually revert to the mean. We also know that the same eight Wall Street darlings of the last 10 years, (Microsoft, Apple, Google, Amazon, Facebook, Tesla, Nvidia, and Netflix) have outperformed everything this year and trade at valuations that imply massive profit growth for a very long period of time. We can take these observations and begin to form an investment strategy using time to our advantage.

A late stage – not new – bull market

Because the same eight stocks skyrocketed this year using ‘AI’ as justification, it tells me that it is possible that we are still in the late stages of a 14-year bull market and last year’s decline was a simple correction. New bull markets usually see different leadership. Apple is now down 10% from its recent high, Nvidia is down 12% and Tesla is down 18%. Some of the froth seems to be coming off in the more speculative stocks. What never made sense to me was this year’s massive stock price rally because it did not tie to improving operating results. Revenues have been flat to down over the last few quarters. The runup in the Magnificent 8 was largely due to multiple expansion and “forward looking statements” not actual results. But lots of things in markets do not make sense.

Prioritize longer-term value over rapid growth

What does this mean? A cautious approach using a value-oriented investment process is still in order. Financial conditions can deteriorate quickly and rampant speculation by leveraged traders abates when they do. We do believe we are in the early stages of a long period when a value approach to stock investing will outperform a momentum based or growth-oriented approach simply because of mean reversion and the expectations implied by the prices of today’s tech stocks are overly optimistic.

It is important to remember that drama free periods are interrupted by drama filled periods. Low volatility predicts high volatility. This is not a reason to change tack or do something different – it is just to mentally prepare for times when conditions change, and if scary headlines start coming in. During those times it is important to take pause to consider what is happening, what it might mean and what to own on the other side of it. Owning good claims on valuable businesses that are well-priced is the best protection from having to do anything rash when conditions change. The people who own high-flying and popular stocks can worry about that.

Additional Investment Wisdom from Howard Marks

“The safest and most potentially profitable thing is to buy something when no one likes it.”

“To beat the market, you must hold an idiosyncratic and non-consensus view.”

“Not only should the lonely and uncomfortable position be tolerated, it should be celebrated.”

“Investment risk comes primarily from too high prices, and too high prices often come from excessive optimism and inadequate skepticism and risk aversion.”

“For investing to be reliably successful, an accurate estimate of intrinsic value is the indispensable starting point. Without it, any hope for consistent success as an investor is just that: hope.”

“The difference between successful people and really successful people is that really successful people say no to almost everything.”

“Investment success doesn’t come from ‘buying good things’, but rather from ‘buying things well’.”

“I like to say, ‘Experience is what you got when you didn’t get what you wanted’.”

“When you boil it all down, it’s the investor’s job to intelligently bear risk for profit. Doing it well is what separates the best from the rest.”

“Many of the great financial disaster we’ve seen have been failures to foresee and manage risk.”

The truth is, the herd is wrong about risk at least as often as it is about return.”

“The possibility of permanent loss is the risk I worry about.”

“Nothing goes in one direction forever. Cycles always prevail eventually. Just about everything is cyclical.”

Can a measurement of time be defined here? Is this true over the past 10 yrs?