A Tale of Two Markets

A Tale of Two Markets

by John Goltermann, CFA, CGMA

Relative to the S&P 500, the first 5 ½ months of the year have been rough for value investors. The S&P 500 is up 15% year-to-date (as of this writing), but value indexes are up 4% year to datei. The S&P 500 does not tell the real story with what is happening with stocks. The Dow Jones Industrial Average is also up 4%, the equally weighted S&P 500 is up 6%, and dividend-paying stocks (as measured by the iShares Core High Dividend ETF) are down 1%ii. In fact, the S&P 500 without the top 5 stocks (Apple, Microsoft, Google, Meta and Nvidia) is up 3%iii.

Why the performance difference?

There has been a huge increase in the prices in technology stocks and the tech sector is 36% of the S&P 500iv. Most other sectors are flat to down. The difference between growth indices (50% tech) and value indices has been enormous. Growth indices are up 28%, marking a 24% return difference to value stocks in 5 ½ monthsv! I have never seen such large internal difference in returns between styles over such a short period of time.

It is one thing to make these observations, yet another thing to explain why. And even another to forecast this kind of price action and position for it. What is happening?

The vast majority of the daily trade is driven by algorithms, not people. As liquidity comes back into the market post-banking-crisis, much of it gets funneled automatically to the largest positions in the S&P 500 (Microsoft, Apple, Amazon, Google and Nvidia) simply because the largest weights are in those stocks. This happens without regard to risk or valuation. Two stocks alone, Microsoft and Apple, account for over 14% of the S&P 500vi.

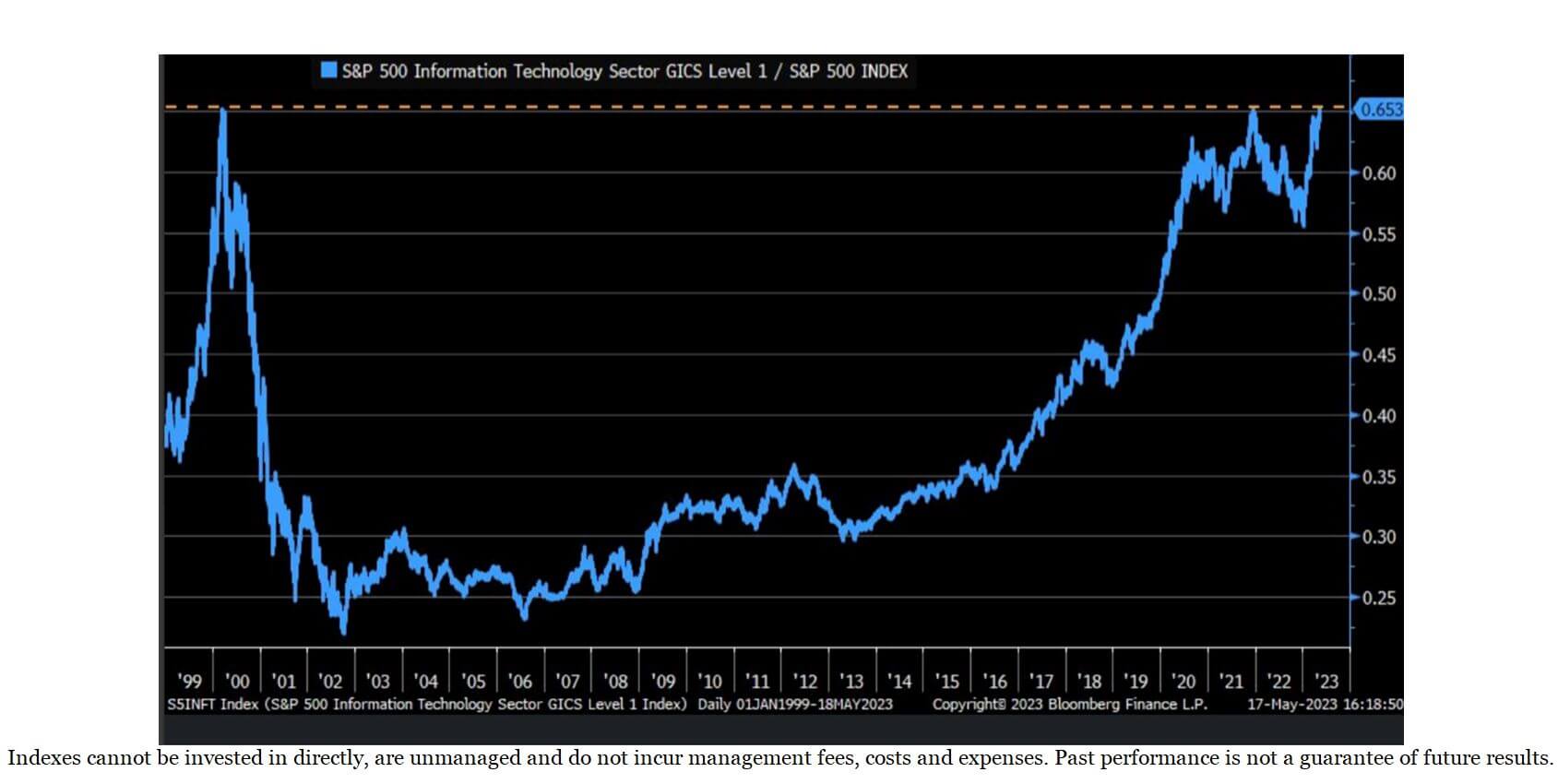

The chart below shows the relative resurgence of tech stocks in 2023. This is mostly led by artificial intelligence (AI) speculation/hype but is probably also largely due to levered speculators unwinding their short tech/long energy positions that they had on through 2022. Why? Because borrowing rates have increased significantly. Therefore, ironically, the tech rally is a form of de-risking. As a result, the S&P tech sector’s relative performance to the rest of the S&P 500 is now beyond where it was at the top of the tech bubble in 2000, and back above its peak in 2021. This is likely a short-term phenomenon, and there is high risk in those positions.

You can also see from the chart above what happened after 2000. There remains significant risk of permanent losses in tech positions as they trade very expensive (on metrics such as price-to-earnings and price-to-sales ratios). Because the algorithms that submit buy orders care very little about how much they pay for those stocks. But as Herb Stein (economist) says, “That which cannot continue forever will stop”.

This level of index concentration in technology strengthens the case for long-term investors to ignore the hype and continue to invest with a margin of safety. AI is the Wall Street hype du jour, so it’s attracting momentum players. But fundamentally the case to own them on a long term (valuation) basis is flimsy as their stock prices imply massive future growth rates that are not likely to materialize. This is the nature of today’s markets…hot money players swinging in and out of positions without regard to valuations.

As an example of extended valuations, according to the modeling work one of my friend’s, David Trainer of New Constructs performed, the $380 recent share price for Nvidia implies heroic future operating results for the company: a 20% revenue growth rate for 20 years, an improvement in operating profit from 27% to 44% and an increase in return on capital from 26% to 778%vii. An unlikely future outcome to say the least, but very few care about the economic reality of these businesses — at the moment.

And what about dividend stocks? They have been disinvested because income seekers can earn 5% in cash. It’s that simple. But this is not a permanent state: Dividend stocks tend to outperform the market in inflationary times and carry much lower price volatility. Stocks that pay dividends tend to be of businesses that have a much greater ability to raise prices in inflationary times. And apart from that, their earnings tend to be high quality as they pay a portion of it out in cash.

What are we doing about all of this? Nothing. Apart from staying focused on the companies we own, and the companies we would like to own (but are too expensive), we have no plan to react to what is happening in markets. We will stick to our process and ignore the short-term noise. It does not pay to chase performance or get caught up in the ululations of Wall Street or the financial media. Our portfolio holds good stocks of good companies. Very little has changed fundamentally from 5 months ago. Just the prices, perceptions and investor preferences have changed.

Our goals are to earn you high returns without overpaying and without taking on risk of permanent losses. It is important to remember that market prices, and changes in those prices, reflect the mishmash of behavior of a bunch of actors (including the programmers of trading algorithms) that operate out of a fear of losing their jobs. It is that simple. For the time being, traders are in the mode of buying AI companies, and selling everything else. But as we see from experience, what happens in the most recent past in markets does not last as economic reality eventually sets in. Valuations and investment fundamentals win out in the long run.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance is no guarantee of future results. Please note that individual situations can vary. Therefore, the information presented here should only be relied upon when coordinated with individual professional advice. The opinions expressed here are those of the author and do not necessarily represent the opinions of Securities America, Inc.

[i] S&P Global data as of June 15, 2023

[ii] S&P Global data as of June 15, 2023

[iii] S&P Global data as of June 15, 2023

[iv] S&P Global data as of June 15, 2023

[v] S&P Global data as of June 15, 2023

[vi] S&P Global data as of June 15, 2023

[vii] Fortune Magazine, May 25, 2023.